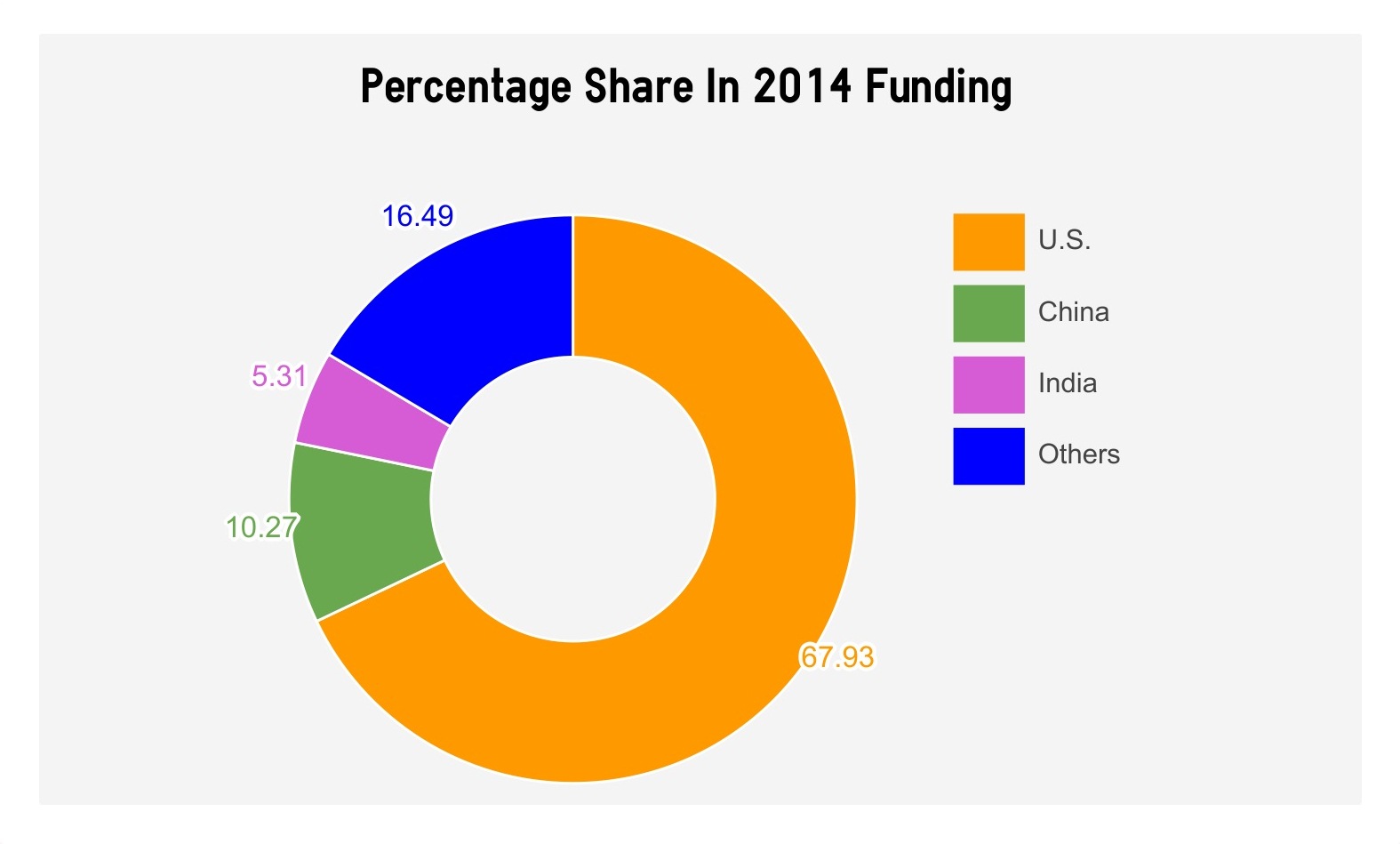

Brimming with young energy, India presently is a fertile ground of opportunities for the businesses of all sizes. In the startup space, market trends project eCommerce, logistics, IT, and the hospitality sectors as the game changers. As they become stronger, the demand for resources - human, capital, and liquid - is also increasing. The share of these sectors in increasing in the GDP and are currently offering improved employment opportunities. A convincing present and the promising 5-year economic outlooks are pulling in huge venture capital (VC) funding from within the India and outside. In 2014, the country with $4.6 billion in its booty is the third highest venture capital funding destination after the US ($58.9bn) and China ($8.9bn). Bangalore topped the national chart claiming over 50% ($2.6bn) of the total funding, followed by NCR and Mumbai.

Besides facilitating the business scale, the cash inflow has also instilled confidence in the entrepreneurs to try out the untested & innovative concepts. Accordingly, diverse funding & financing patterns are enforced when sealing the deals. While the early stage Venture Capital funding is limited in terms of investment, returns, and management control, the Private Equity (PE) players get to steer the businesses to quite a degree. With a much higher investment bandwidth, they have a wider ownership stake and therefore, a pivotal role in the company's strategic decision-making. Although VCs sometimes find a profitable exit a challenge, the PE firms look at a patient 5 to 10-year projection. Another funding type, the angel investors can get involved, even at the seed money stage and aim mostly for big multipliers, usually within a 5-year term. The bottom line is that VCs (in any format) prefer to scout for newer ideas with a potential for returns.

Set up in 1993, the Indian Private Equity & Venture Capital Association (IVCA) aims to organize a venture capital and private equity industry in India to encourage entrepreneurship and business innovation. Since 2006, the association has witnessed growth, which accelerated in 2009. Needless to add, the tech and e-commerce funding sweeps the 'propagating' list. With Flipkart standing tall at a total of approx. $1200 million in August 2014, Snapdeal is second with around $233 million, surely a massive lag from its competitor. Quikr follows next with $90 million. Myntra, ANI Technologies, Hungama Digital Media, Freshdesk, iYogi, Jabong, BigTree, all fall in the $25-$50 funding band, in that order.

Eurion Constellation is research and consulting firm helping Indian startups and MSMEs in a variety of business areas including funding. For more information, please log on to http://www.eurionconstellation.com or mail at contact@eurionconstellation.com